Study Notes for Investment

0 Report

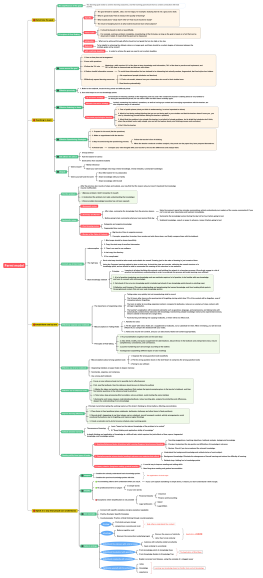

This comprehensive guide to investment study notes provides an in-depth overview of key investment principles and strategies. It begins with an introduction to investments, covering the definition, types (stocks, bonds, real estate, commodities), and the crucial tradeoff between risk and return. Fundamental concepts such as the time value of money, risk management through diversification and asset allocation, and the principles of market efficiency and behavioral finance are elaborated. For stock market investments, the guide explains the basics of shares, exchanges, and indices, along with valuation methods like the price-to-earnings ratio and dividend discount model. Various investment strategies, including value, growth, and momentum investing, are also discussed. The bond market section details different types of bonds (government, corporate, municipal), bond valuation techniques, and associated risks like interest rate and credit risk. Real estate investments are explored through types (residential, commercial, REITs), valuation methods (cap rate, net operating income), and financing options (mortgages, leverage). The section on alternative investments includes commodities (gold, oil, agricultural products), private equity, venture capital, hedge funds, and derivatives. Investment strategies are contrasted between long-term investing versus short-term trading and passive versus active investing, highlighting the importance of portfolio management, asset allocation, and rebalancing. Risk management is thoroughly covered, emphasizing risk assessment, risk tolerance, insurance, hedging strategies, and contingency planning. Investment analysis is detailed through financial statement analysis (balance sheet, income statement, cash flow statement), company and industry research, and technical analysis using charts, trends, and indicators. Finally, the guide addresses ethics and regulation, including a code of ethics for investors, the regulatory framework (SEC, FINRA, FCA), and issues like insider trading and market manipulation. By incorporating these insights, investors can make informed decisions, manage risks effectively, and adhere to ethical standards, ultimately enhancing their investment success.

Related Recommendations

Other works by the author

Outline/Content

See more

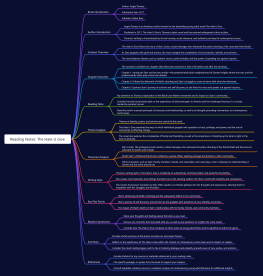

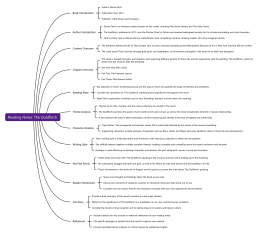

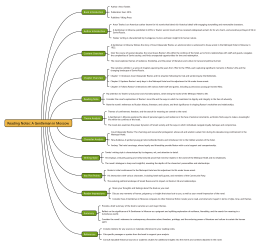

Introduction to Investments

Definition of Investment

Types of Investments: Stocks, Bonds, Real Estate, Commodities, etc.

Risk and Return: The Investment Tradeoff

Fundamental Concepts

Time Value of Money: Present Value, Future Value, and Compound Interest

Risk Management: Diversification, Asset Allocation

Market Efficiency and Behavioral Finance

Stock Market Investments

Stock Market Basics: Shares, Exchanges, Indices

Valuation Methods: Price-to-Earnings Ratio, Dividend Discount Model

Investment Strategies: Value Investing, Growth Investing, Momentum Investing

Bond Market Investments

Types of Bonds: Government Bonds, Corporate Bonds, Municipal Bonds

Bond Valuation: Yield to Maturity, Coupon Rate

Bond Risks: Interest Rate Risk, Credit Risk

Real Estate Investments

Types of Real Estate Investments: Residential, Commercial, REITs

Real Estate Valuation: Cap Rate, Net Operating Income

Real Estate Financing: Mortgages, Leverage

Alternative Investments

Commodities: Gold, Oil, Agricultural Products

Private Equity and Venture Capital

Hedge Funds and Derivatives

Investment Strategies

Long-Term Investing vs. Short-Term Trading

Passive vs. Active Investing

Portfolio Management: Asset Allocation, Rebalancing

Risk Management

Risk Assessment and Risk Tolerance

Insurance and Hedging Strategies

Contingency Planning and Emergency Funds

Investment Analysis

Financial Statement Analysis: Balance Sheet, Income Statement, Cash Flow Statement

Company and Industry Research

Technical Analysis: Charts, Trends, Indicators

Ethics and Regulation

Code of Ethics for Investors

Regulatory Framework: SEC, FINRA, FCA, etc.

Insider Trading and Market Manipulation

Collect

Collect

Collect

Collect

0 Comments

Next Page