US Stock Market IPO Flowchart: From Private to Public

0 Report

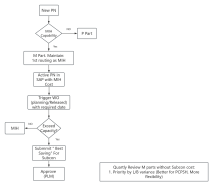

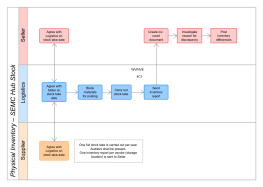

The 'US Stock Market IPO Flowchart: From Private to Public' outlines the critical steps a company must undertake to transition from a private entity to a publicly traded one. This flowchart details the comprehensive journey, starting with the decision to raise capital through public markets and culminating in the company operating as a public entity. Key processes include ensuring compliance with NASDAQ/NYSE listing requirements, conducting financial audits, and preparing the S-1 filing. The flowchart also highlights the SEC review and approval, pre-IPO marketing activities, and the IPO day when shares start trading, ensuring a structured pathway to successful public listing.

Related Recommendations

Other works by the author

Outline/Content

See more

Ensure compliance with NASDAQ/NYSE listing requirements.

Conduct Financial Audits & Prepare S-1 Filing

Stock Exchange Listing Approval

Audit financial statements to meet SEC regulations.

Key Steps in the U.S. IPO Process

SEC Review & Approval

Decision to raise capital through public markets.

IPO Day: Shares Start Trading

Hire Underwriters & Legal Team

Company Operates as a Public Entity 🎉

SEC reviews the prospectus for compliance and investor protection.

Company Plans to Go Public

Submit S-1 Registration Statement to SEC

If issues are found: Company must amend & resubmit S-1.If approved: Move to pre-IPO marketing.

Set IPO Price & Finalize Offering

Present to institutional investors to generate demand.

Pre-IPO Roadshow & Investor Meetings

Company officially becomes publicly traded.

Post-IPO Compliance & Reporting

0 Comments

Next Page